Attorneys Recommend Our 5% Down* Program. "It's the Best Program in L.A. & Orange County." We Also Have a Paid in Full 6.9% Premium on $10,000 Bonds and Larger. We Are Very Flexible and We Can Help You. We Have a Program for Everyone! Fast-Honest-Reliable, We'll Walk You Through the Whole Bail and Court Process.

Call NOW!

(714) 279-0333, (310) 803-9560

(626) 593-5857, (562) 553-0058

Bail Bonds for Los Angeles County, Orange County,

Riverside County and San Bernardino County

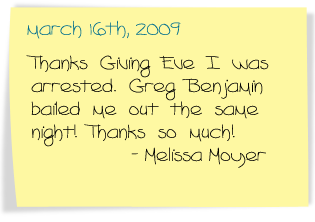

Greg Benjamin Bail Bonds offers:

-

Free phone consultations

-

24-hour service

-

Confidential service

-

Honest, Courteous and Professional service

-

Lowest Prices allowed by California State Law

-

Flexible Collateral Plans

-

Payments by Credit Card

Call NOW!

(714) 279-0333, (310) 803-9560

(626) 593-5857, (562) 553-0058

Bail Bonds Only 5% Down! Easy Payment Plans!